The latest statistics indicate growing signs of a housing recovery, but mark any recovery as tentative.

Increasing strength could be undercut in a number of ways. Among the uncertainties are unemployment, mortgage rates, the condition of both the U.S. and global economies, and consumer confidence. Also to be considered is the so-called “shadow inventory.”

Still, new information suggests that perhaps we are not only seeing the proverbial light at the end of the tunnel, but possibly our journey through the tunnel has ended.

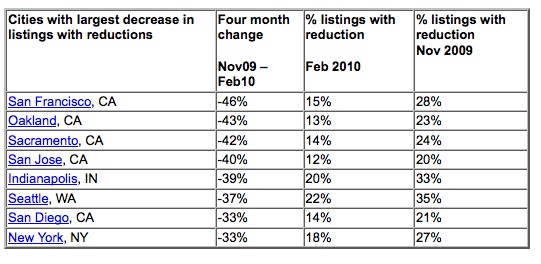

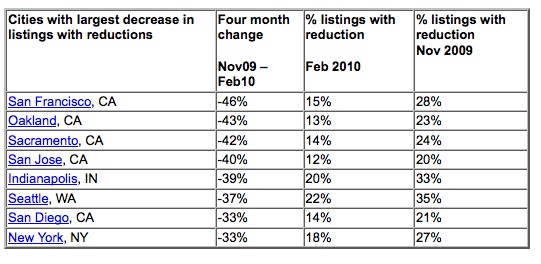

Trulia finds inventory plunging and percentage of price cuts trending down.

The news in the last day or two is, of course, conflicting. There is evidence that the supply of housing has dropped dramatically (in the chart above); builder confidence is inching up; home construction of new homes jumped in January; the Conference Board said today that its index of leading indicators ticked up by 0.3 percent; today’s inflation measure shows an unexpected rise; it could take up to 33 more months to dispose of the supply of homes facing foreclosures; and some economists foresee another dip in the housing market.

Continue reading →